This guide provides a quick overview of the three ways to trade (buy/sell) cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

Background

I first started writing about cryptocurrencies in 2013 and mined Bitcoin from my laptop that year. I also had the pleasure of being quoted by Minyanville for an analysis in my article titled, Bitcoin Arbitrage, Scalping Market Inefficiencies, and Currency Market Share Gradual Shift, which appeared on Yahoo Finance.

Fast-forward to today, and the market for alternative investments has grown exponentially. Cryptocurrencies have surged in popularity – thanks to the proliferation of financial technology (Fintech) that has fueled the adoption of non-bank financial products sought by investors, and powered by distributed ledger (blockchain) technology.

Powered by Blockchain Technology

According to data from CB Insights, the amount of venture capital (VC) funding invested in fintech companies reached a new quarterly record in Q2 2017 of $5.19 billion, of which $232 million was invested in blockchain/Bitcoin companies.

Replacing the need for any trusted third party, Blockchain technology is being used to power and verify cryptocurrency transactions belonging to public addresses (that hold bitcoin) controlled by private keys (used in bitcoin wallets) across decentralized networks.

According to data from CoinMarketCap, cryptocurrency universe market capitalization is at yet another all-time high of $139 billion as of August 14, 2017.

The bulk of the value is held by Bitcoin (nearly 50%), with the cryptocurrency trading just above $4,200. Using price data from Bitstamp, the chart snapshot below from TradingView shows daily candlestick prices for Bitcoin versus the US Dollar (BTC/USD), depicting how steep Bitcoin's price rise has been in 2017.

Emerging Alternative Asset Class

Needless to say, Bitcoin’s place as an alternative digital asset among cryptocurrencies has become entrenched, despite likely headwinds it will continue to face as it evolves further. The U.S. Securities and Exchange Commission (SEC) announced in early August 2017 that certain Initial Coin Offerings (ICOs) – which use cryptocurrencies for financing – would be regulated as securities.

Shortly thereafter, the Chicago Board of Options Exchange (CBOE) followed, saying that it would be launching options on cryptocurrency derivatives, as investors are already looking at different ways to incorporate digital assets such as Bitcoin into their portfolios.

Many investors now recognize cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) as asset classes. Therefore, knowing the three ways to trade this cryptocurrency can be useful for Bitcoin investors (and can be applicable to other cryptocurrencies).

Quick Pointer: Trading costs, including any commissions and fees for trading cryptocurrencies, can be substantial, reaching well over $1,000 per $1,000,000 worth of currency or more, compared to trading the same amount in fiat (non-digital) currencies in the foreign exchange (forex) market.

After going over the three ways to trade Bitcoin, we will extend our exploration into the pros and cons of each way, and then provide a bottom line for each category and an overall summary further below.

How to Trade Bitcoin

Below are the three ways you can trade Bitcoin:

- Buy the underlying from an exchange or online cryptocurrency broker (holding the actual currency in a wallet at the exchange or off-site)

- Trade (buy/sell) a CFD (Contract for Difference) derivative and hold cash margin with an online forex broker or multi-asset broker.

- Buy a publicly listed security related to Bitcoin and hold shares with an online stockbroker.

Buying the Underlying (Actual) Asset: Pros and Cons

Taking the first option listed above, which is to buy the underlying, you become the direct holder of the digital asset. Upon purchase, the cryptocurrency is sent to your bitcoin address or account (wallet) with the exchange. From there, you can transfer the cryptocurrency to any bitcoin address or wallet address using the private key that verifies you control ownership of the asset.

This responsibility to safeguard your private key which controls the digital asset also comes with some additional risks, as explained below. First, we will go over the positive sides of owning the underlying digital asset.

Pros

- You control the actual underlying digital asset.

- Most versatile option (can be transferred, sold, exchanged/converted).

- Can be secured with the use of a private key or by the exchange's wallet

- No third party counter-party risk when the private key is held in cold storage offline.

- Multiple payment wallet options are available to store/transfer the asset.

Cons

- Private Key that may be unique to each address must be safeguarded (your responsibility).

- Technical knowledge may be required to carry out operations.

- The lost private key may equate to a lost asset (unrecoverable).

- If the private key is stored at the exchange where you bought the Bitcoin, it could be hacked and your Bitcoin could be stolen from the exchange.

- Third party wallets can get hacked or subject to malware/phishing and your Bitcoin can get stolen.

- If you keep the private key offline only (cold storage) and lose your private key and not able to recover it your Bitcoin is lost forever.

- You must remember your password or private key if you store your Bitcoin electronically or be sure you can recover your private key (the easier this is, the more prone your Bitcoin is to potential theft by hackers).

Bottom line

For long-term investors who are willing to actively safeguard their Bitcoin, owning the underlying is clearly the way to go, but prudent steps must be taken to mitigate the risk of Bitcoin theft and/or loss of private keys (i.e., diversifying holdings across wallet/storage types, using two-factor authentication and strong passphrases).

Bitcoin Exchanges

- Coinbase – 3.5 Stars Overall

- Binance

- Bitfinex

- Bittrex

- Kraken

- Poloniex

- Swissquote – 4 Stars Overall

- (via Bitstamp)

- Z.com Trade (GMO Coin offering)

It is important investors realize not all exchanges and brokers that offer delivery of the underlying Bitcoin are created equal. Some firms have fallen victim to theft by hackers who have stolen Bitcoin belonging to clients whose money was held at the exchanges. Meanwhile, other Bitcoin exchanges have gone bankrupt (as in the case of Mt. Gox), as a result of fraud or mismanagement.

This counterparty risk and risk of loss from hackers is another reason why some investors don’t hold their Bitcoin on exchanges directly but transfer it to an independent wallet (which carries its own risks, as outlined above).

Nonetheless, choosing an exchange that meets your needs is important. For US-based investors, CoinBase is one of the leading exchanges to offer cryptocurrency trading on Bitcoin and recently integrated with Fidelity Investments so Fidelity clients can see their Coinbase balances from their Fidelity brokerage accounts.

For non-US clients, Swissquote – a major forex brokerage/bank in Switzerland – has teamed up with Bitstamp to offer actual deliverable Bitcoin. And Japan-based GMO Click Holdings, another one of the largest forex brokers by volume, has launched its GMO Coin offering for Bitcoin investors.

Trading Bitcoin as a CFD/Derivative: Pros and Cons

Pros

- Trading a CFD or derivative on Bitcoin negates the responsibility to safeguard any private keys.

- A greater degree of leverage is usually offered on derivatives so your cash margin can have more buying power (increased risk/reward).

- CFD/derivatives permit shorting by opening a selling position without first having a long (buy) position, for those looking to speculate on a decline in prices of the underlying.

- Brokers may be able to offer lower transaction fees, although spreads may be slightly wider or marked up, depending on the liquidity sources the brokerage uses.

Cons

- Spreads (trading cost) are usually wider compared to trading the underlying.

- Trades may be canceled or reversed in the event the broker finds fault in its systems (price, etc.) or if it finds a client violates their particular account agreement with the said broker (agreements vary).

- Clients rely on the creditworthiness of the online broker for managing any risk prudently and ensuring that it is well capitalized (less risk of going defunct).

- Margin trading means there is a chance of a negative balance occurring in the case of huge market volatility, a gap, or other Black Swan systemic event.

- In such cases, counterparty risk falls on the broker, which means if the broker declares bankruptcy, investors may suffer substantial losses and not receive priority among creditors.

Bottom line

Active traders looking to speculate on Bitcoin over the short or medium term may find that trading CFD/derivatives on Bitcoin using an online forex broker will provide them with 24hour trading, potentially lower margin, and the ability to go either long or short. Because of counter-party risk, choosing a broker is just as important as finding one with the best trading tools or commission rates.

Forex brokers that offer (margin trading) Bitcoin as a CFD

- Admiral Markets – 3.5 Stars Overall

- ADS Securities – 4 Stars Overall

- Alpari – 4 Stars Overall

- AvaTrade – 3.5 Stars Overall

- eToro – 4 Stars Overall

- ETX Capital – 3.5 Stars Overall

- Forex Club – 3.5 Stars Overall

- FXOpen – 3 Stars Overall

- Henyep (HYCM) – 3.5 Stars Overall

- IC Markets – 4 Stars Overall

- IG – 4.5 Stars Overall

- iTrader – 3.5 Stars Overall

- Markets.com – 3.5 Stars Overall

- Pepperstone – 3.5 Stars Overall

- Plus500 – 3 Stars Overall

- TickMill – 3.5 Stars Overall

- ThinkMarkets – 3.5 Stars Overall

- VantageFX – 3 Stars Overall

- WWM – 3.5 Stars Overall

- XTB – 4 Stars Overall

- XM – 3.5 Stars Overall

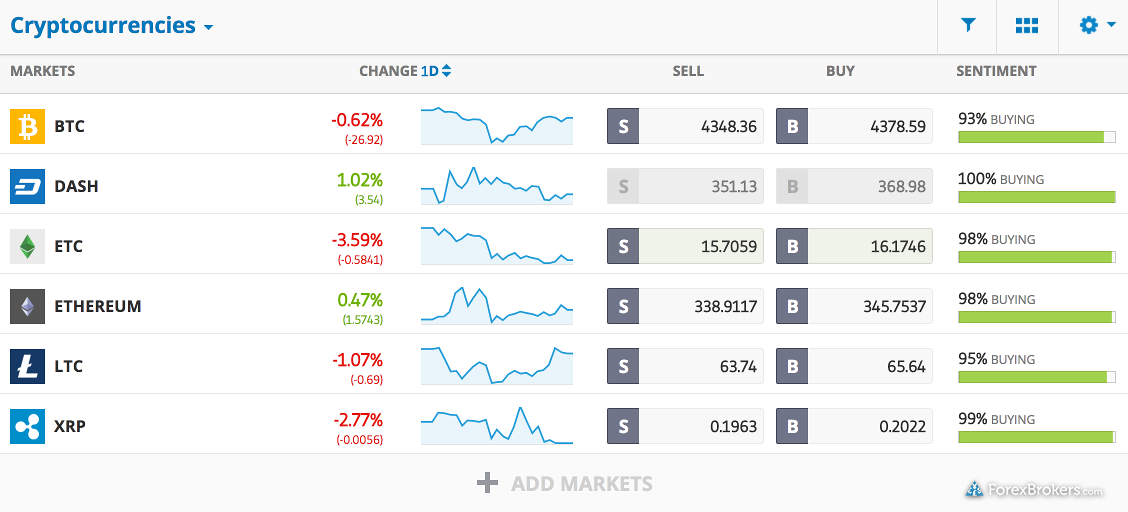

Example of trading bitcoin (BTC) and cryptocurrencies on eToro's web platform:

Buying Bitcoin-Related Securities (ETFs, ETPs, etc.): Pros and Cons

Pros

- Trading Bitcoin-related security that aims either to replicate the performance of the asset or act as a trust that holds Bitcoins, where investors don’t need to hold private keys, provides traders an alternative investment vehicle to buy and hold (long only).

- Doesn’t require safeguarding private keys

- Trades as a publicly listed security on the exchange under exchange guidelines.

Cons

- The price of the security and the price of the underlying asset (Bitcoin) may vary, causing a tracking error, either due to fees or other differences in the portfolio construction methodology.

- The security may only be tradeable during exchange hours, and not 24 hours a day as is the case with Bitcoin.

- A volume of the traded security may be less than the available volume of the underlying asset (making it illiquid).

- Bid/ask spreads and other fees may be different than the cost of buying the underlying directly.

Bottom line

For stock market investors, investing in Bitcoin indirectly through listed security such as an ETF, ETP, or trust may be suitable for those looking at taking a passive position. Active traders might find the limited trading hours and potential lack of volume a limiting factor that could hinder their trading. Overall, using listed securities that invest, track, or hold Bitcoin can be a viable alternative to diversify away from the risks of margin trading or safeguarding private keys when buying the underlying.

Stockbrokers that offer Bitcoin-related securities and/or futures trading

- Saxo Bank – 4.5 Stars Overall

- Interactive Brokers – 4 Stars Overall

- TD Ameritrade – 4.5 Stars Overall

- E*Trade – 4 Stars Overall

- Fidelity – 4.5 Stars Overall

- Charles Schwab – 4.5 Stars Overall

- TradeStation – 4 Stars Overall

Industry Developments for Bitcoin-related Securities

Following the ETF for Bitcoin proposed by the Winklevoss Twins for regulatory approval but rejected by the SEC, there are only a handful of options available as regulators try to tackle the current challenges posed by investment firms that want to create cryptocurrency-related investment vehicles including on Bitcoin.

There is also an Ethereum-based ETF pending regulatory review, and many such products are likely to follow. For now, there are just a few options available. For example, ticker symbol GBTC is one such security listed on the US-based OTC Markets Exchange, and is available at major online brokerages such as Fidelity, providing stock market investors a way to gain exposure to Bitcoin without buying the underlying or using a derivative.

GBTC is backed by one of the largest venture capital firms that specialize in Bitcoin and is affiliated with a substantial group of related businesses headed by Barry Silbert – a prominent Bitcoin investor and industry figure.

Final Thoughts

Following the recent hard fork that happened with Bitcoin in early August 2017, where the network split into two separate blockchain versions after a majority of miners decided to create a new branch, a new coin called Bitcoin Cash (BCH) was awarded to every Bitcoin (BTC) held prior to and through the fork event.

Events such as these can pose issues for Bitcoin-related trusts such as GBTC, depending on how such events are handled and the degree of any proceeds distributions and administrative fees. For that reason and the pros/cons noted above, Bitcoin-related securities would not be my first choice when looking at the three ways to trade this asset.